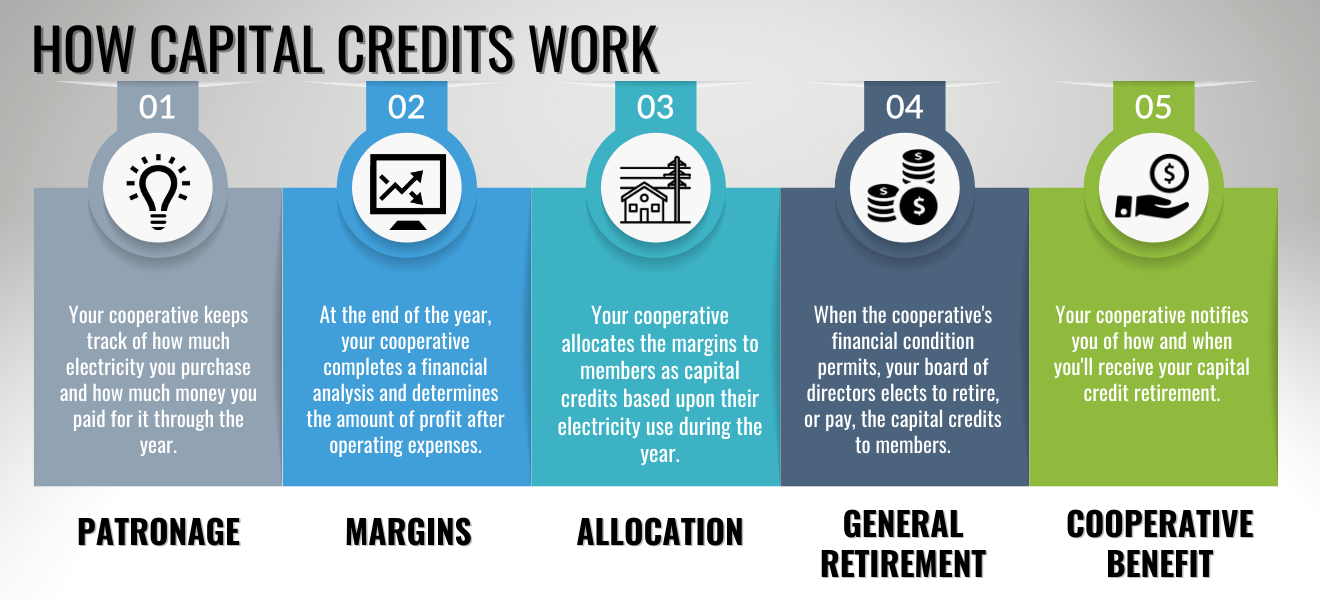

Capital credits are retained margins at the end of the year that are distributed or allocated back to the member-owners of Red Lake Electric. Allocated capital credits aren’t payable to the member right away because the cooperative uses them as a significant source of equity to help pay operating costs and secure loans. They are eventually paid to the member as long as the financial condition of the cooperative is strong!

Member-owned, not-for-profit electric utilities like Red Lake Electric set rates to generate enough money to pay operating costs, make payments on any loans and pay for wholesale power. At the end of each year, the expenses of the cooperative are subtracted from the total amount of revenues collected throughout the year and the remaining balance is called a “margin.”

Margins are allocated to members as capital credits based on their purchases from the cooperative — how much power the member used. Member purchases may also be called patronage.

Once a year you may receive notification of an allocation on your bill statement. The notification is an informational notice to let you know about your share of the capital credits that will eventually be paid to you when a general retirement is issued by the board of directors. An allocation represents your share of ownership in a nonprofit, member-owned cooperative.

Each year, the Red Lake Electric board of directors makes a decision on whether to refund capital credits based on the financial health of the cooperative. During some years the co-op may experience high growth in the number of new accounts added or severe storms may result in the need to spend additional funds to repair lines. Both events might cause the board to defer any capital credit refunds. For this reason, Red Lake Electric’s ability to return margins to members in the form of capital credits reflects the cooperative’s strength and financial stability.

Doing so follows one of our seven cooperative principles —Members’ Economic Participation. This principle states: “Members are allocated surpluses for any or all of the following purposes: developing the cooperative, possibly by setting up reserves and benefiting members in proportion to their transactions with the cooperative; and supporting other activities approved by the membership.”

No. Capital credits only exist at not-for-profit electric cooperatives owned by their members.

Capital credits are tax free if the property served by Red Lake Electric was used strictly as a residence. If the residence was used for business purposes, members should contact their tax advisors.

Capital credits can be paid out in an accelerated retirement to settle an estate. If the estate representative elects to take an accelerated retirement of the capital credits, the calculation for the retirement is based on the net-present value of money. The cooperative has determined this procedure to be fair for our membership as a whole, since the rest of our members must keep their capital credits invested in the cooperative until they are retired during a general retirement.

If a check is received that was issued to a deceased member, in a joint name after a divorce or any other incorrectly issued check, please contact our Member Service department at (218) 253-2168 or (800) 245-6068. You will be asked to provide identification or legal documentation to prove your representation of the estate or record in an effort to resolve the issue.